I’ve always felt a little different to the majority of people in my attitude to money and spending. I’ve always been a saver from an early age, I’m bewildered when I see people racking up credit card debt and even feel uneasy paying the bank interest on a mortgage. I recently discovered Mr Money Mustache, a Financial Freedom blogger who ‘retired’ from his software job at 31.

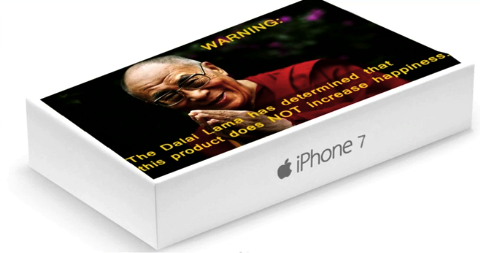

His tagline ‘Financial Freedom through Badassity’ aims to help others achieve the same freedom that MMM has, and tries to convince everyone that it’s actually quite an easy goal, which most people don’t believe, and that ‘buying more stuff’ is not the way to happiness anyway. He has around 50k visitors to his site every day, and a community of Mustahcians following the same ideas.

Recently he recorded a video talk that expresses these ideas really simply and makes them very accessible. I recommend you watch this now as the rest of what I say won’t make sense without the context. It’s only 25 mins, and quite entertaining.

so.. hopefully you watched the video :-)

Every aspect of this talk gels with me completely. Since I’ve not been working I’ve become even more sensitive to the commercialism around us and am actively trying to avoid it. Reflecting on this, it’s not because I want to be more frugal. I think that when you’re working hard to earn money, then buying things seems like some kind of ‘reward’ for the hard work and sacrifice. Now, I just want to protect that freedom by not wasting money on stuff I don’t really need that doesn’t make me happy anyway. I found myself in a Westfield mall a few weeks ago and I literally felt sick walking around the shops looking at how expensive ‘fashion’ and ‘luxury’ is, and that so much effort and money goes into marketing and advertising to suck almost everyone into buying this stuff when they can’t afford it at all.

I find it genuinely confusing how so many people find shopping fun, and seem to get some kind of buzz from shopping malls.

The personal debt aspect is particularly important for Australia, as we have the highest personal debt in THE WORLD. When I wrote this the personal debt on Australian Debt Clock was $145 billion of which $48 billion was credit card debt! Wow! Just Wow!

Just like the Americans, Australians are set to never retire, which will have a massive impact on the economy and future generations. And for what? A bigger house and a fancier car.

I also particularly like the response to people who say ‘but I really like my job’. There’s so much truth that financial freedom doesn’t stop you working, it just removes ties and opens up a world of opportunities and possibilities. Personally, I now find myself exploring many different ideas I’d never have thought possible in the wage trap and it’s possible to just start thinking about the aspects of life that you enjoy, then finding meaningful work that aligns.

The main point here that I think is most misunderstood is that financial freedom isn’t just for the 1 percent of highest income earners, with $million salaries, or for people who only live on beans on toast, it’s just about following the simple rule of spending less than you earn. This is even simpler when you consider people’s salaries generally increase over time, especially in professional careers, so it’s just a case of us not letting our spending increase with (and often above) our incomes.

I’d like to research more why my perspective seems to be different to so many people out there. I also watched some of Dan Ariely’s Behavioural Economics talks about personal finance and I don’t really seem to fall into a lot of the bias traps around this either. They just seem illogical. I don’t have a particularly unique background, and I can’t blame being a naive Canadian like Mr Money Mustache. I was brought up to think about savings and be careful with money, but many parents teach that to their kids, and it doesn’t seem to correlate. I don’t want my kids to suck at money.

Saving isn’t boring. Not being able to do what you enjoy with your life is boring! Go out and save!

From my time at home so far, I’ve realised that I an much happier when I can be outside, not chained to a desk, and I really like building things. This isn’t a surprise given how much I’ve always enjoyed being a programmer. I spent half a day last week building a pool slide for the kids, which I would have never been able to do if I didn’t have the spare time at home. I don’t think I’ll be building any houses any time soon but it was a heap of fun and even if I say so myself, it’s pretty awesome :-)